What is Bank FeedsBank Feeds A Codat product that enables automatic synchronization of bank transaction data into a company's accounting software.?

A bank feed is a digital connectionConnection A link between a Codat company and a data source (like an accounting platform). Each connection represents authorized access to pull or push data from that platform. between a financial institution and an accounting software that performs an automatic regular transfer of bank statements into the software.

Leverage our Bank FeedsBank Feeds A Codat product that enables automatic synchronization of bank transaction data into a company's accounting software. solution to simplify the deployment of bank feedsBank Feeds A Codat product that enables automatic synchronization of bank transaction data into a company's accounting software. in your application. It creates the associated infrastructure for you and automates the upload of bank statements into accounting software used by your small and medium-sized business (SMBSMB The primary customer segment that Codat helps businesses serve, typically companies with annual revenues under $500 million.) customers.

Who is it for?

Our Bank FeedsBank Feeds A Codat product that enables automatic synchronization of bank transaction data into a company's accounting software. solution makes it easy for banks, neobanks, corporate card issuers, and payment providers to ensure customers can access their bank transaction data within their accounting software.

As a result, your customers enjoy a more complete and simplified accounting experience, save time closing their books, and further reduce manual error without requiring third-party middleware or manual file uploads.

Why use it?

A recent survey revealed that 71% of Xero partners identify bank feeds and bank transaction reconciliation as their most valued features. With Bank FeedsBank Feeds A Codat product that enables automatic synchronization of bank transaction data into a company's accounting software., you can easily meet this demand.

Leverage our coverage of the most popular accounting software and remove barriers to product adoption, increasing customer retention and elevating their experience with your app as a result.

With Bank FeedsBank Feeds A Codat product that enables automatic synchronization of bank transaction data into a company's accounting software., you can:

Reduce churn

When your services integrate effortlessly into your customer's tools and processes, they're less likely to switch to a competitor.

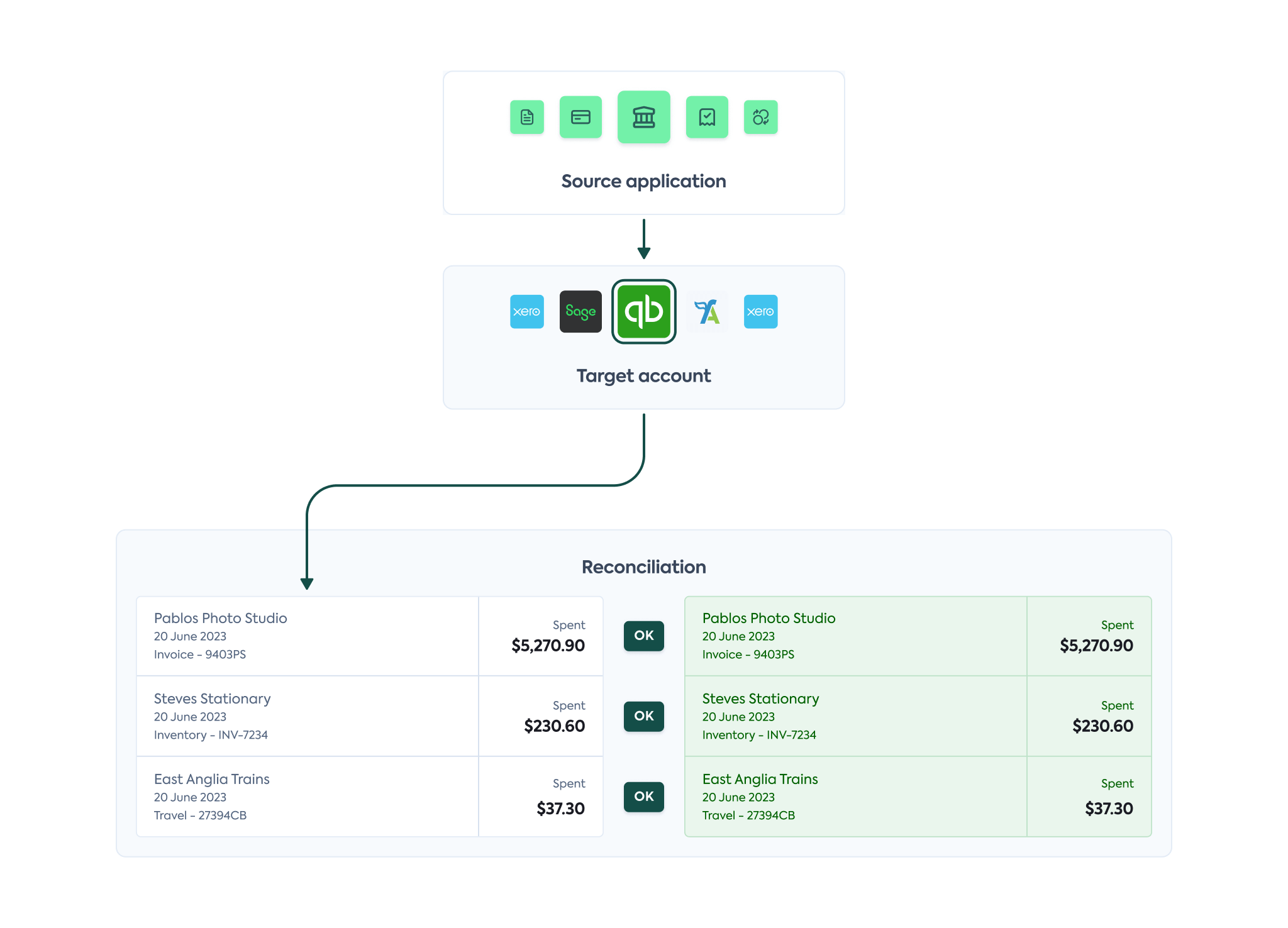

Improve accuracy

We help your customers close their books faster and with fewer manual errors.

Keep balance up to date

Near real-time balances help your customers manage their finances more effectively and make the right choices.

How does it work?

Bank FeedsBank Feeds A Codat product that enables automatic synchronization of bank transaction data into a company's accounting software. supports your build through all the key stages of establishing a bank feed and using it to automatically upload bank statements to your SMBsSMB The primary customer segment that Codat helps businesses serve, typically companies with annual revenues under $500 million.' accounting software.

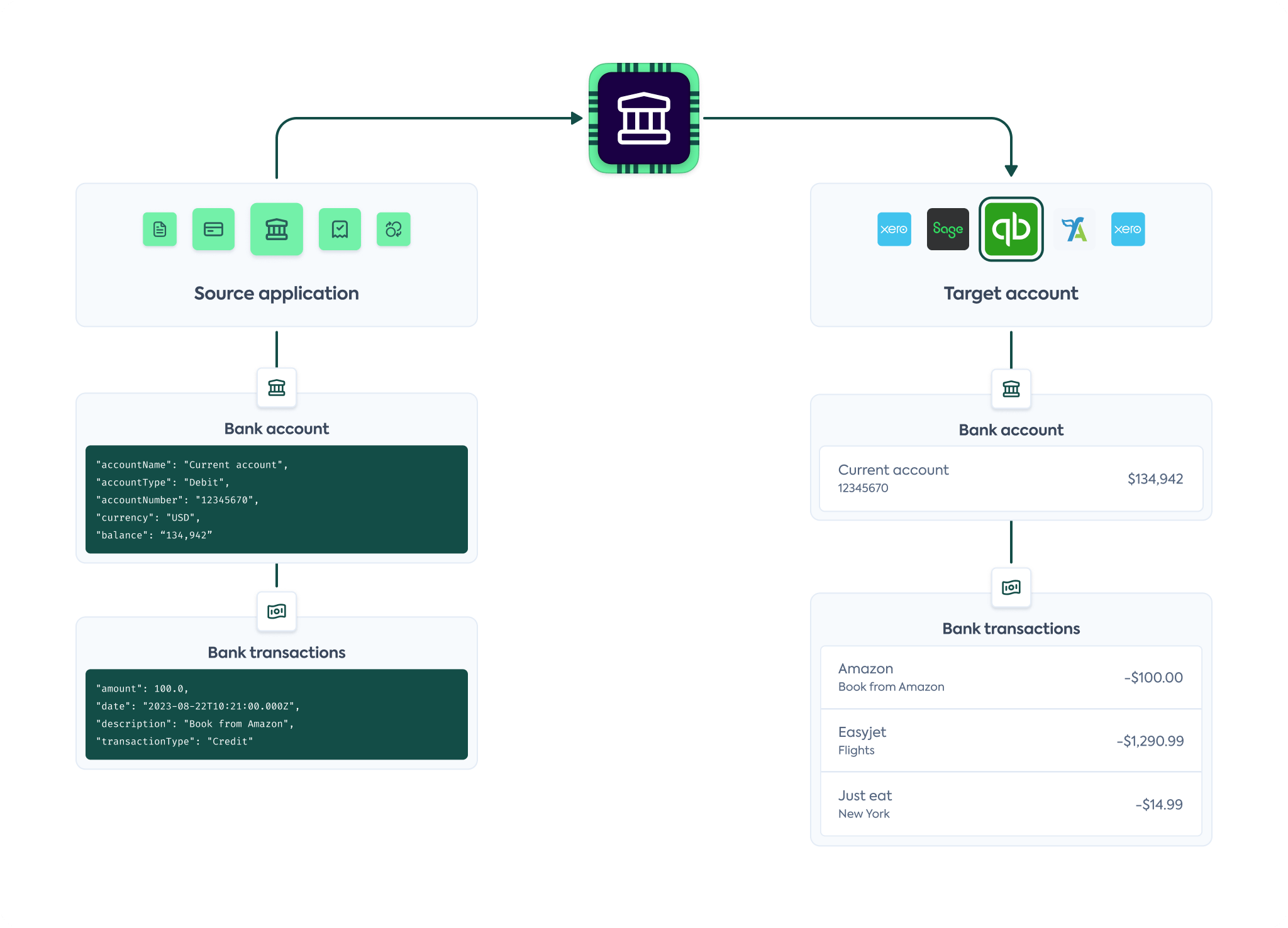

Configure customer

To establish a bank feed between a financial institution and an accounting software, you will create a source account in Codat that serves as replica of an actual financial account, savings account or credit card. This account can later be mapped to a target account in your customer's accounting software.

At the same time, you will also create additional Codat infrastructure elements, such as a company and a connection.

Establish bank feed

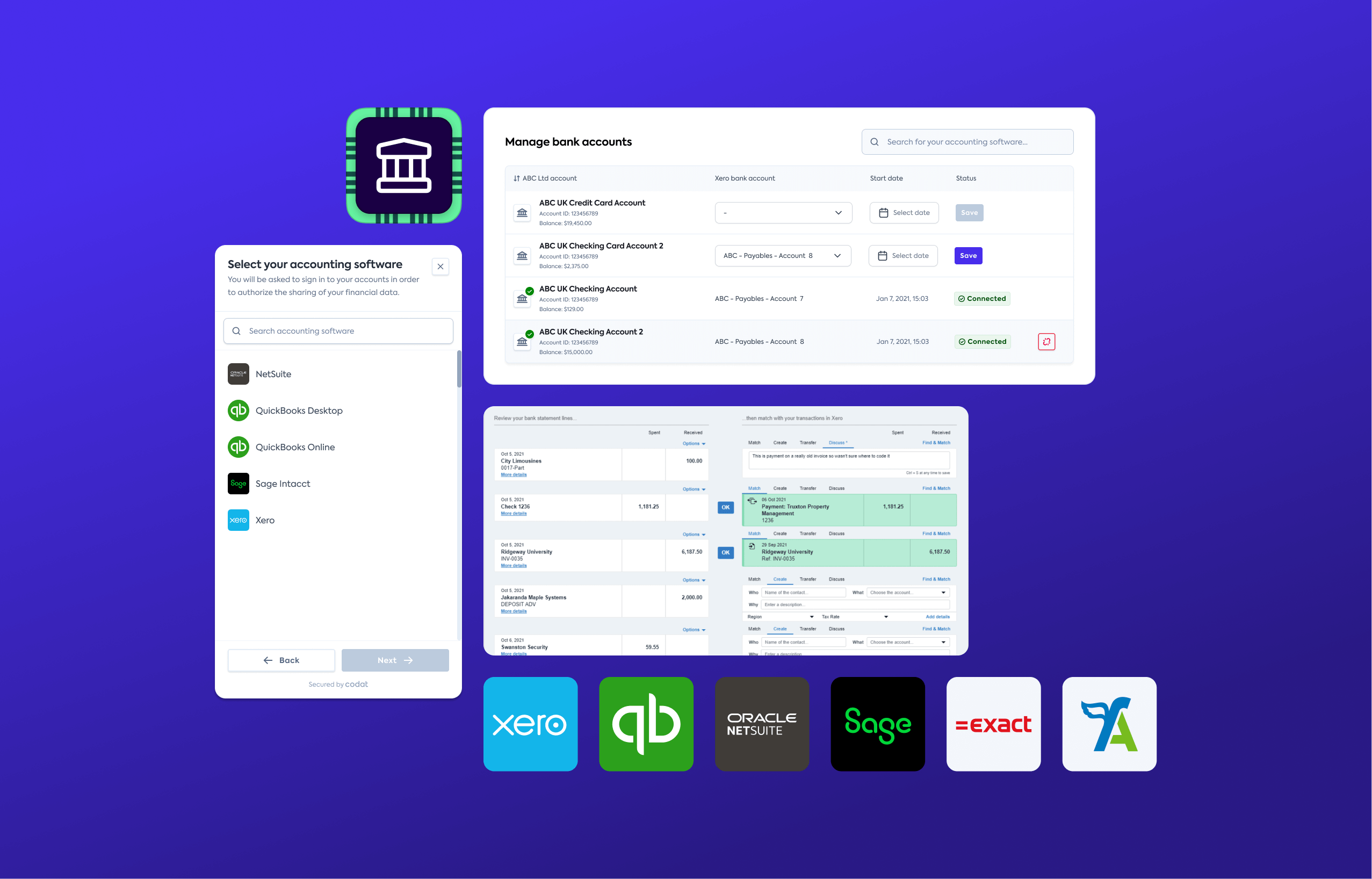

Next, you will enable your SMBSMB The primary customer segment that Codat helps businesses serve, typically companies with annual revenues under $500 million. customer to let you connect to their accounting software. They will authorize that connectionConnection A link between a Codat company and a data source (like an accounting platform). Each connection represents authorized access to pull or push data from that platform. via our auth flow, which you will implement when building with Bank FeedsBank Feeds A Codat product that enables automatic synchronization of bank transaction data into a company's accounting software..

Then, provide your user with a UI so they can select the target accounts in that platform. This will tell Codat where exactly to establish a bank feed. Depending on your customer's software, there are three methods you can use for mapping: Codat's UI, your own UI, or the integration's UI.

The setup process and platform registration requirements vary for each Bank Feeds integration. For detailed instructions, refer to the documentation we provide for each integration.

Import transactions

Once your SMBSMB The primary customer segment that Codat helps businesses serve, typically companies with annual revenues under $500 million. customer completes the authorization and account mapping process, you can begin the automatic upload of bank statements by writing transactions into the target bank account on the accounting software.

Supported integrations

Build with client libraries

Our low-code Bank Feeds SDK lets you build a seamless high-converting user experience, embedded right within your frontend application.

In your backend code, you can use our comprehensive SDKs to kickstart and simplify your developer journey deploying bank feedsBank Feeds A Codat product that enables automatic synchronization of bank transaction data into a company's accounting software. in your application. The SDKs come in multiple languages and provide sample requests and responses for the full range of bank statement automation scenarios.

Read next

- Start building with our Bank FeedsBank Feeds A Codat product that enables automatic synchronization of bank transaction data into a company's accounting software. solution

)