Xero troubleshooting

Frequently asked questions and troubleshooting guidance for our Xero integration

Data type behavior

Items

When writing Items to Xero, the type of the items must be either Inventory or Unknown. When writing Inventory items, Codat looks up a pre-existing Inventory Account from Xero. This account is used for inventory tracking in Xero when an item is bought or sold.

The validity of the taxRateRef.id property on the Item depends on the value of the associated accountRef.id on the bill item or invoice item. Some tax rates can only be associated with certain types of accounts; for example, Asset, Liability, Income, Expense, or Equity.

Accounts

When reading account balances from Xero, the balance and the currency always use the companyCompany In Codat, a company represents your customer's business entity. Companies can have multiple connections to different data sources.'s base currency in Codat. This applies even if the source nominal accounts are in a foreign currency. This is how the information is retrieved from the Xero APIAPI A set of rules and protocols that allows different software applications to communicate with each other. Codat provides APIs for accessing financial data from accounting, banking, and commerce platforms..

Your application's user interface

If you provide your SMBSMB The primary customer segment that Codat helps businesses serve, typically companies with annual revenues under $500 million. customers with an application, we recommend you implement a setup page that allows them to connect to Xero and manage integration settings without any assistance from your support or onboarding teams.

Consider including the following features:

- Ensure that the name of their connected business displayed in your application matches the name in the accounting software.

- Include a button that allows them to disconnect the app from the integration.

- If the customer disconnects the app, alert them about it and provide an opportunity to reconnect.

- When off-boarding customers from your product, ensure you disconnect from their accounting software and don't access their data anymore.

- Inform users of any errors through error logs, messages or alerts.

You can also review Xero's own advice and best practices.

FAQs

What is the Xero App Partnership Program? How can I join it?

If you want to have more than 25 Xero connectionsConnection A link between a Codat company and a data source (like an accounting platform). Each connection represents authorized access to pull or push data from that platform., you'll need to join the Xero App Partner Program.

Follow our guide here.

How can I set up a bank feed to a Xero account?

For instructions on setting up a bank feed to an account in Xero, see the Xero Bank Feeds documentation.

How do I write negative Direct incomes and Direct costs to Xero?

The Xero APIAPI A set of rules and protocols that allows different software applications to communicate with each other. Codat provides APIs for accessing financial data from accounting, banking, and commerce platforms. doesn't allow the creation of Direct costs (spend money transactions) or Direct incomes (receive money transactions) with negative values.

To support writing negative values to Xero for these data types, our integration uses some custom logic.

| When you write... | Codat creates... |

|---|---|

| A negative Direct income to Xero | A positive spend money transaction in Xero |

| A negative Direct cost to Xero | A positive receive money transaction in Xero |

When writing negative Direct incomes and Direct costs to Xero, be aware that both the type (Direct income or Direct cost) and the sign of the created business objects are reversed.

You write negative Direct incomes and Direct costs to Xero as an array of lineItems in an Account transaction, the same as for other accounting integrations. Arrays can contain a mix of both positive and negative lines.

{

...

"contactRef": {

"id": "699f0091-b127-4796-9f15-41a2f42abeb2",

"dataType": "suppliers"

},

"issueDate": "2023-02-28",

"currency": "GBP",

"lineItems": [

{

"description": "negative direct cost, no tax",

"unitAmount": 35,

"quantity": -1, // negative

"subTotal": -35, // negative

"taxAmount": 0,

"totalAmount": -35, // negative

"accountRef": {

"id": "02c0e212-9afb-4983-9c67-120656ff8d03"

}

}

],

"paymentAllocations": [

{

"payment": {

"accountRef": {

"id": "bd9e85e0-0478-433d-ae9f-0b3c4f04bfe4"

},

"currency": "GBP"

},

"allocation": {

"totalAmount": -35

}

}

],

"taxAmount": 0,

"totalAmount": -35

}

If the write is successful, the changes array in the write operation response will show the reversed data types that were created.

Reading negative Direct incomes and Direct costs from Xero

It's possible to create negative spend money transactions and receive money transactions in the Xero UI. Objects created in this way are always read to Codat as negative Direct incomes and negative Direct costs, respectively (that is, they are not reversed).

How are Xero contacts represented in the Codat APIAPI A set of rules and protocols that allows different software applications to communicate with each other. Codat provides APIs for accessing financial data from accounting, banking, and commerce platforms.?

In Xero, contacts only become a customer or a supplier once an AP or AR transaction is applied to them e.g. an invoice or a bill. Up until this point, they remain as just a contact and not a customer or a supplier within Xero.

To cater for this behavior in the Codat standard, contacts appear as both Customers and Suppliers if they are a contact in Xero. This allows you to always find the ID for a contact to create either a bill, or an invoice say (as any contact may be used in both AP or AR context).

How might Xero rate limits affect my integration?

Requests to the Xero APIAPI A set of rules and protocols that allows different software applications to communicate with each other. Codat provides APIs for accessing financial data from accounting, banking, and commerce platforms. are subject to the APIAPI A set of rules and protocols that allows different software applications to communicate with each other. Codat provides APIs for accessing financial data from accounting, banking, and commerce platforms. rate limits described in the OAuth 2.0 API limits page in the Xero Developer documentation.

If a rate limit is exceeded, your integration is blocked from making any more requests to the APIAPI A set of rules and protocols that allows different software applications to communicate with each other. Codat provides APIs for accessing financial data from accounting, banking, and commerce platforms. until the conditions of the rate limit are met. A Pending status is shown in the write endpoint response when a rate limit is enforced.

If the Daily Limit is exceeded, you can't syncSync The process of fetching the latest data from a connected data source. Syncs can be triggered manually or run automatically on a schedule. any data with Xero for up 24 hours depending on when the limit was exceeded.

To see which rate limit is exceeded, please contact Codat Support.

Why do all of my items from Xero have their status as Unknown?

All Items from Xero will have their itemStatus mapped as Unknown in Codat because an item status is not exposed via Xero's APIAPI A set of rules and protocols that allows different software applications to communicate with each other. Codat provides APIs for accessing financial data from accounting, banking, and commerce platforms.. If this is a feature you'd like to see made available, please consider voting for this feature request on Xero's UserVoice.

Can I write discounts to Xero at the invoice level?

Yes. You can enter negative line item amounts in the lineItems.unitAmount field when writing invoices to Xero. This is an alternative to using the discountAmount and discountPercentage fields.

Why do I get an error when writing tracking categories to Xero?

Our accounting data model allows the reading and writing of Xero tracking options rather than parent tracking categories. You can have up to two active tracking categories and up to 100 tracking options for each tracking category. For more information about these objects, see Set up tracking categories in the Xero documentation.

You can only write a tracking category to Xero if it has a non-null value for parentId.

You are unable to write tracking categories that, when they were read, have the property "hasChildren": true. A validation error is returned.

Why do I see only 5 years' of bank transactions for my Xero connectionsConnection A link between a Codat company and a data source (like an accounting platform). Each connection represents authorized access to pull or push data from that platform.?

For performance reasons, the default date range for reading bank transactions from Xero is the past five years.

If you need to increase or decrease this date range, edit the value of the syncFromUTC property for the bankTransactions data type in your additional syncSync The process of fetching the latest data from a connected data source. Syncs can be triggered manually or run automatically on a schedule. settings (via a request to POST /companies/{companyId}/syncSettings).

You can set syncFromUTC for all companies or individual companies. For more information, see Advanced sync settings or raise a ticket with our support team through our support request form.

Why do I see a different reference value when I read bank transactions to Xero that I'd previously written?

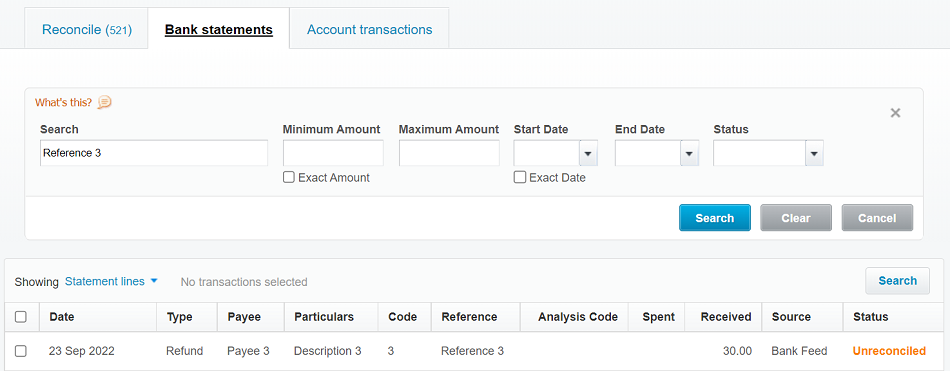

There is a limitation in the data sets returned from Xero when reading Bank transactions to Codat. The Particulars, Reference, and Code values, which are visible in columns in the Xero UI, are returned together in the description field, concatenated and separated with spaces.

The Payee in Xero is read to Codat as the counterparty of the Bank transaction.

For example, the Statement line below will result in a bank statement line with a counterparty of Payee 3 and a description with the value: Description 3 Reference 3 3.

Can I write batch payments to Xero?

Yes. To write a batch payment to Xero, you write a Bill payment with multiple line items. Writing a batch payment to Xero will create the following business objects:

- A separate bill payment for each line.

- An account transaction that linksLink The authorization flow that allows end users to connect their accounting, banking, or commerce platforms to your application via Codat. the bill payments together.

In the returned write operation:

- The

changesproperty lists the objects that were created in Xero to represent the batch payment. - The

dataproperty is not populated because there isn't one single object that can be used to represent the batch payment in Xero.

For example:

{

"changes": [

{

"type": "Created",

"recordRef": {

"id": "1f0dc0ac-f512-45b5-90d3-ba3956b6a5b4",

"dataType": "billPayments"

}

},

{

"type": "Created",

"recordRef": {

"id": "1fd01ad4-ef3b-43fd-adf9-084f31c324cf",

"dataType": "billPayments"

}

},

{

"type": "Created",

"recordRef": {

"id": "b4be5708-aeb0-453a-90c2-4151f0e59778",

"dataType": "accountTransactions"

}

}

],

"dataType": "billPayments",

"companyId": "12e34cc7-cae8-452e-ba9f-04650f756b3e",

"pushOperationKey": "b728ea77-1a67-422f-b65f-98155b5cbb33",

"dataConnectionKey": "4b301fcd-c79e-4591-926d-ef69ea3ead7d",

"requestedOnUtc": "2022-09-16T16:12:15.2748051Z",

"completedOnUtc": "2022-09-16T16:12:19.0866399Z",

"status": "Success",

"statusCode": 200

}

For certain bills and invoices, why does the sum of the line items not add up to the exact Total Amount?

In Xero, it is possible for an end user to overwrite the total of an AR/AP Invoice to within 0.10 decimal places of the total of the line items. The adjustment is attributed to a rounding account, but left off from being a line item on the bill itself. Codat does not throw an error in these cases, but instead logs a warning. These warnings are visible via the read.completed webhook payloads, or the Get Validation Results endpoint