What is it?

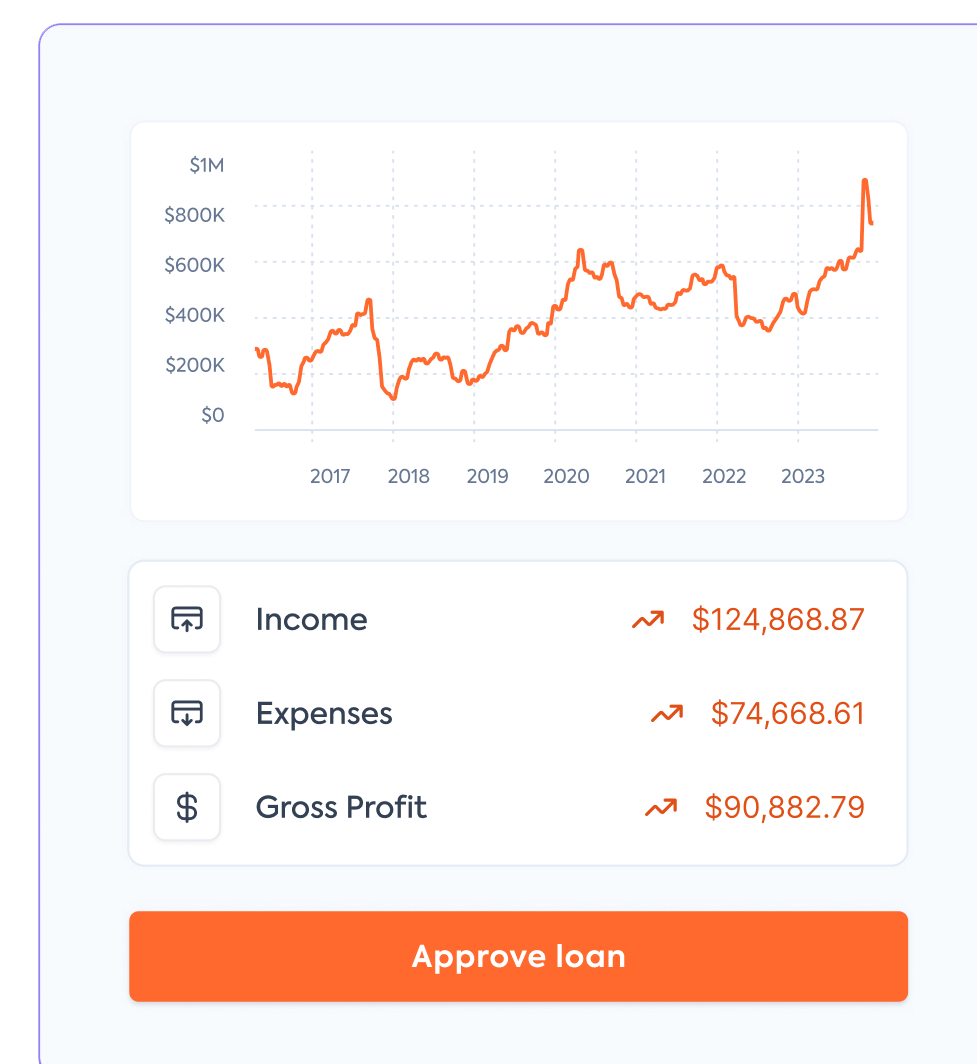

Our Lending solution is built on top of the latest accounting, commerce, and banking data, providing you with the most important data points you need to get a full picture of SMBSMB The primary customer segment that Codat helps businesses serve, typically companies with annual revenues under $500 million. creditworthiness and make a comprehensive assessment of your customers.

Who is it for?

Our Lending solution is best for digital lenders, neobanks, corporate card providers, and commerce software who want to make an assessment of a small business's financial health and performance.

Why use it?

We have done the heavy lifting for you by building integrations to the platforms your customers already use and handling the complexity of standardization. Our Lending solution comes with a range of features that make customer data easier to collect and process, and gives you insights you didn’t have before on the accuracy of the data shared.

With Lending, you can:

- Automate affordability assessments using categorized bank data.

- Assess financial strength of a companyCompany In Codat, a company represents your customer's business entity. Companies can have multiple connections to different data sources. with our debt report.

- Streamline ratio calculation with categorized financial statements.

- Refresh borrower data at any time without the need for costly manual data collection.

Features

Our Lending solution empowers you with a host of features to help you streamline your underwriting process:

Bank statements

Underwrite with accurate, real-time cash flows enriched with spend and income categories.

Sales

Underwrite with real-time data from SMBSMB The primary customer segment that Codat helps businesses serve, typically companies with annual revenues under $500 million.'s payments and shopping platforms.

Financial statements

Automate financial statement and ratio analysis with a fully standardized profit and loss and balance sheet.

Liabilities

Comprehensive loan insights and credit history analysis.

Accounts receivable

Assess debtor risk in real time with accounts receivable insights.

Accounts payable

Enhance underwriting precision with streamlined accounts payable insights.

Supported integrations

Accounting

Banking

Commerce

Build with client libraries

Use our comprehensive SDKs to kickstart and simplify your developer journey automating the collection of your customers' financial data and making an assessment of a small business's financial health and performance.

Our Lending SDK comes in multiple languages and provides all the necessary methods to build your solution, enabling you to develop everything from a merchant capital product to loan writeback with just a single SDK.

Read next

- Get started building with our Lending solution