Reconciling bank transactions with Codat

An overview of the bank transactions reconciliation use case supported by Codat

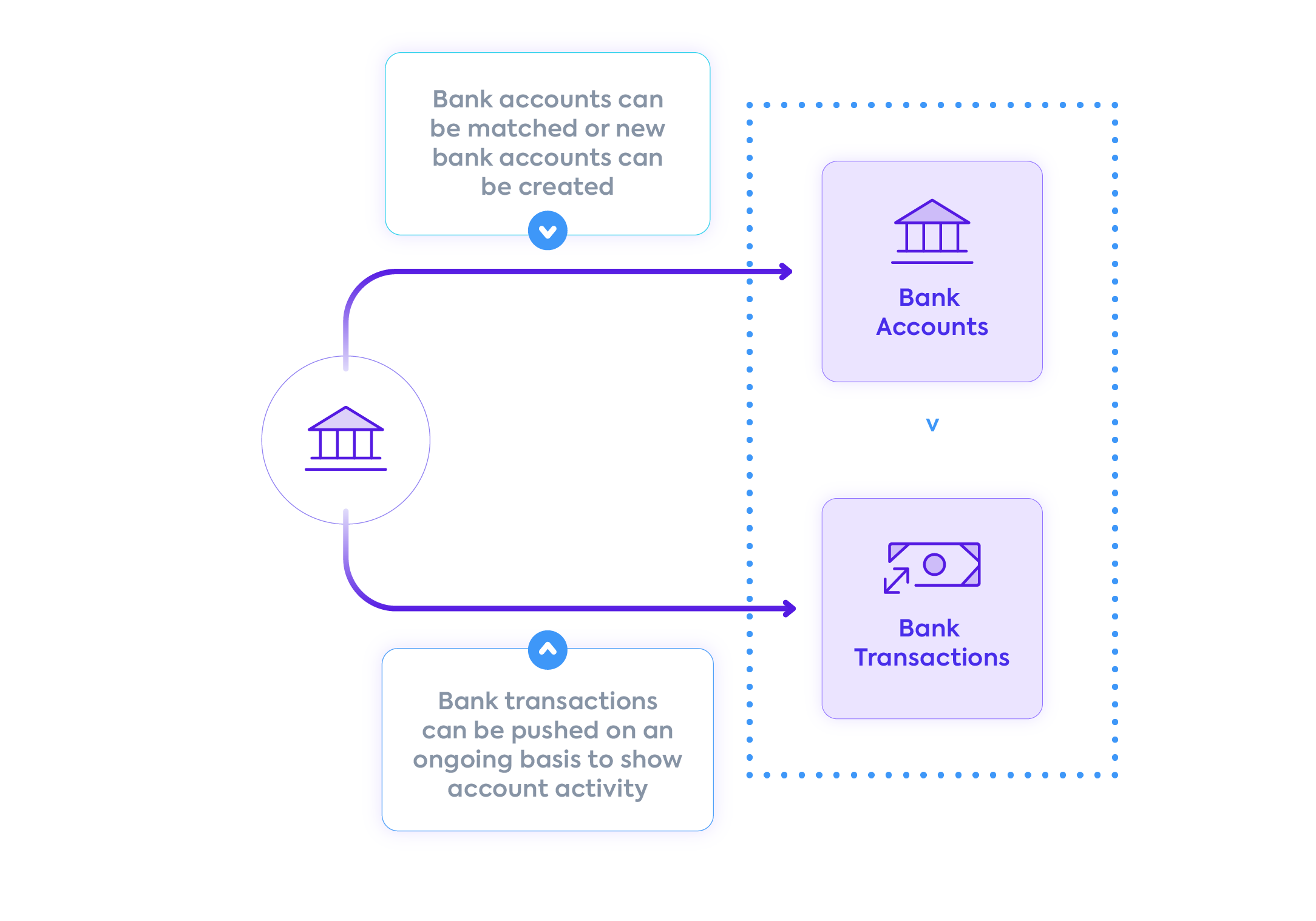

Support your customers by writing their bank transaction data into their accounting software' bank transaction ledgers to ensure these records match each other.

How Codat can help

We can support traditional banks and neobanks in their activity by leveraging our Bank Feeds API product. We have done the heavy lifting for you by building integrations with a standardized data model to the accounting software your customers already use. This gives you access to real-time data that you can read, create, or update to support your use case.

Bank reconciliation is the process of ensuring that the information in a business’s accounting records matches the information in their bank account. Traditionally, this would be done by comparing a bank statement to the ledger entries, but our Bank Feeds API makes it possible to upload bank transactions to the accounting software.

This saves your customers time by removing manual entry and importing bank transactions, removes the potential for errors, and facilitates matching by providing additional details, like a merchant's name.

Relevant products

Bank Feeds API

Use case tutorials

Looking for code to launch your usecase asap? Check out our guides:

-

Bank transactions reconciliation with QuickBooks Online

In this tutorial, see how you can support your users by syncing their bank transaction data to QuickBooks Online, ensuring the records match each other.

Read next

Review the full range of use cases Codat can support you with and find one that suits you best.